Humans & Capital: Dynamics of scale in social systems

Quantity has a quality all it’s own.

–Napolean (or maybe Stalin, we’re not sure)

A strange thing happens when human systems grow. They have a tendency to be guided less by relationships between humans and more by relationships between capital. At scale, capital is a standardized and reified token of trust that doesn’t require individuals to know each other as they would have in small, pre-monetary tribal societies. Capital is well-suited for large-scale cooperation, but this cooperation comes at a cost. This is my sketchpad for one possible way to think about human systems and capital. The basics are captured in two interrelated dichotomies:

Human cooperation has diminishing return at scale.

Capital cooperation has increasing returns at scale.

and

At small scales, capital is a tool for humans.

At large scales, humans are a tool for capital.

Human cooperation has diminishing returns at scale.

I arrived at a party unfashionably early last night, and noticed what happens to social dynamics as group size grows. A conversation between four people was maintained effortlessly. As other guests arrived, however, engaging everyone in a single conversation became difficult and unnatural. Little factions of conversation broke off – the latest gossip in the kitchen, a political debate on the patio, intimate flirtation in the hallway – until the party was composed of lots of little conversation groups.

It turns out social scientists have studied this phenomena. Researchers recently determined that the maximum group size for interactive dialogue is four people. Any larger than 4 people and the mode of conversation becomes a serial monologue in which dominant speakers emerge. In other words, a conversation with a larger group isn’t so much a conversation as individuals speaking at a group in turn. Without active facilitation the conversation naturally splinters into smaller groups to maintain interactive dialogue.

This splintering is the result of our limited cognitive capacity. You can use Metcalfe’s Law to understand how larger groups spiral into complexity by considering how many unique relationships are formed by increasing group size. For every person added to the group, the number of unique relationships increases as a function of n(n – 1)/2. A group of four people has 6 unique relationships, while a group of five people has 10 unique relationships (see the network diagram above).

Ten unique relationships is more than our working memory can manage. Cognitive psychologist George Miller determined that the number of objects we can keep in our minds at a given time is seven, plus or minus two. If your relationship with each individual is an object to be maintained in working memory you can see how your cognitive capacity is quickly overwhelmed by even slightly larger groups. Interactive communication deteriorates with scale.

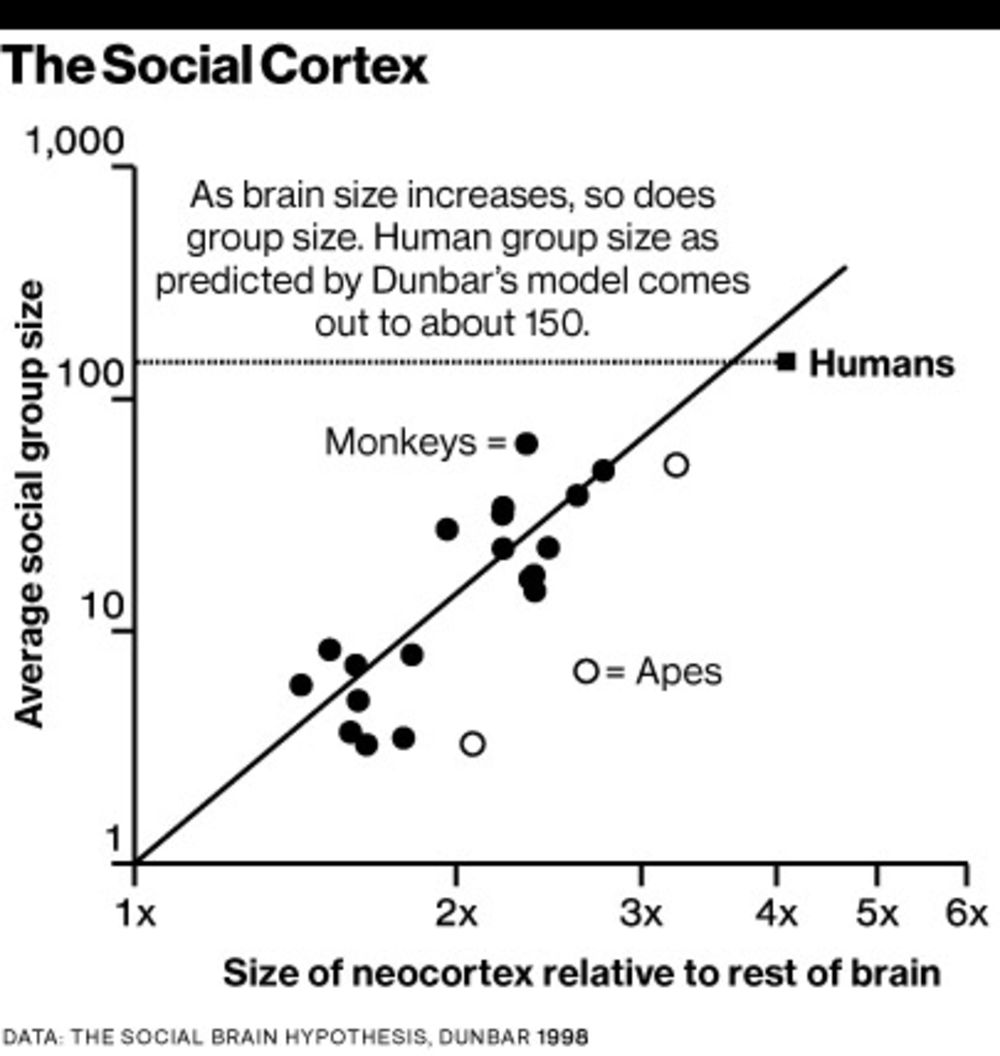

At larger scales and longer timelines, the Dunbar number – 150 people (or at least somewhere between 100 and 230 people) – suggests a cognitive limit to the number of human relationships that can be adequately maintained in a community before social ties break down.

150 is the standard population size of neolithic farming communities, Roman armies, and Hutterite and Amish communities today. It’s about the biggest a group can get before people start becoming strangers to one another. Much like the researchers studying conversation dynamics at scale, anthropologist Robin Dunbar showed how this limit to community size is a function of our innate cognitive capacity.

Human communication and the relationships they compose break down with scale. It’s only through intersubjective narratives–like financial relationships–that stable cooperation can occur beyond the Dunbar number.

Capital cooperation has increasing returns at scale.

Unlike humans, capital cooperates more easily at larger scales.

A study by economist Gabriele Camera of Chapman University found that group size had a major influence on cooperation. When two players in a game operated on a non-monetary system of trust–in which players trust that favors given will be returned by the other player–players helped one another out 71% of the time. In groups of 32 people playing the same trust-based game, this reciprocity fell to 28%. This non-monetary trust-based system quickly deteriorated at scale.

When the game incorporated a monetary system in which favors were bought and sold with currency (rather than simply trusting that other players will reciprocate), the relationship with scale flipped. Small group cooperation dropped by 19%, whereas people in large groups cooperated almost twice as frequently than they did without the monetary system. Increasing scale shifts effective relationships from trust in individuals to trust in currency.

Unlike human communication and relationships, capital is a more efficient mode of cooperation as the system grows. Efficient cooperation at scale produces increasing returns at scale when the system is a company (and in plenty of other cases when it isn’t). This is closely related to economies of scale in neoclassical economics. It’s cheaper to be bigger.

The expanding scale of globalization has enabled a compounding effect for capital. Scale means access to more markets, more demand, more supply, and more return on capital investment. Superstar effects are accelerated by network effects and regulatory capture, producing exaggerated power law distributions in which the big gets bigger. Large companies absorb small companies and get bigger still.

In particular, the tech sector is the beneficiary of zero-marginal cost business models. It costs roughly the same to develop software for 100 paying users as it does to develop software for 1,000,000 paying users. It also requires roughly the same number of employees, thereby bypassing the diseconomies of scale caused by (human) cooperation costs that arise in other industries.

Capital has its own organizational logic. This is why Marxists call for working class solidarity and the capitalist class doesn’t need to.

At small scales, capital is a tool for humans.

This is immediately apparent through the frictionless transactions of our daily lives. My neighborhood grocer stays in business because my neighbors and I need food. The owner takes care of his family with the capital flowing from us to him. He invests in his businesses and gives his nephew a job. He pays taxes that go into public infrastructure so people can get to his business. He spends that money at other businesses and the cycle continues.

At small scales, economic development is real and it works. When capital is shared and power differentials are minimal, the free exchange of labor and capital creates opportunities for improved well-being.

At small scales, money is a token of trust exchanged face to face. Money facilitates cooperation and competition (which, when all players obey the rules of the game, is simply a productive form of cooperation for solving certain problems). It’s a tool for achieving mutually desirable goals, for facilitating optimism that tomorrow can be better than today, and often for delivering on that promise.

At large scales, humans are a tool for capital.

Capital, however, always wants to grow. It is blind in its desire to grow–it pays no attention to how big it already is. It knows only that growth is good. When there is an opportunity for capital to grow, it is capable of mobilizing vast swaths of the planet’s population to make it happen. Even if the CEO of the world’s largest corporation decided his company was large enough didn’t need to get any bigger, the investors would revolt and the board would have him replaced overnight. All of this human activity would be animated by capital’s need to grow. We unironically call the value of humans to capital accumulation human capital.

In Sapiens, Yuval Noah Harari explains how wheat conquered the planet, spreading from a tiny area of the middle east to the entire globe.

Wheat did it by manipulating Homo sapiens to its advantage. This ape had been living a fairly comfortable life hunting and gathering until about 10,000 years ago, but then began to invest more and more effort in cultivating wheat. Within a couple of millennia, humans in many parts of the world were doing little from dawn to dusk other than taking care of wheat plants. It wasn’t easy. Wheat demanded a lot of them. Wheat didn’t like rocks and pebbles, so Sapiens broke their backs clearing fields. Wheat didn’t like sharing its space, water, and nutrients with other plants, so men and women labored long days weeding under the scorching sun. Wheat got sick, so Sapiens had to keep a watch out for worms and blight. Wheat was defenseless against other organisms that liked to eat it, from rabbits to locust swarms, so the farmers had to guard and protect it. Wheat was thirsty, so humans lugged water from springs and streams to water it. Its hunger even impelled Sapiens to collect animal feces to nourish the ground in which wheat grew.

Despite the care and labor, wheat did us few favors in return.

The body of Homo sapiens had not evolved for such tasks. It was adapted to climbing apple trees and running after gazelles, not to clearing rocks and carrying water buckets. Human spines, knees, necks, and arches paid the price. Studies of ancient skeletons indicate that the transition to agriculture brought about a plethora of ailments, such as slipped disks, arthritis, and hernias. Moreover, the new agricultural tasks demanded so much time that people were forced to settle permanently next to their wheat fields. This completely changed their way of life. We did not domesticate wheat. It domesticated us. The word “domesticate” comes from the Latin domus, which means “house.” Who’s the one living in a house? Not the wheat. It’s the Sapiens.

In 1982 artist Agnes Denes was commissioned by New York City’s public art fund to plant and harvest wheat in downtown Manhattan. The land was worth $4.5 billion. The piece was intended as social commentary for our misplaced priorities, contrasting our perspective on food versus real estate, but perhaps the wheat is better thought of as a parallel to capital than a foil.

The relationship between humans and wheat is parallel to the relationship between humans and capital. We did not domesticate capital. It domesticated us. Psychological studies have found that money can improve subjective well-being – but only at small scales. Past ~$75,000/year, more money has no effect on individual happiness. Economists call this the law of diminishing marginal utility; as supply grows, the marginal value of each unit (say, of dollars) falls.

Yet diminishing marginal utility does nothing to capital’s desire to grow. If it can maximize growth by buying favors from politicians, it will do so to the best of its ability. If it can pay workers less and still get value out of them (say, by acquiring or colluding with the competition for labor), it will.

This pattern is not a matter of people being greedy. This is the result of the impregnable incentive structures created by systems of capital at scale. In this system, the human is a conduit for expansion. Jeff Bezos is as much a tool for capital as the Amazon warehouse worker he employs.

At the scales of global neoliberalism, humans don’t leverage capital. Capital leverages humans.

None of this is to suggest that large scale systems are inherently bad. We need large scale cooperation (likely facilitated through the relationships of capital) in order to tackle global issues like climate change or antibiotic resistant germs. What’s important to remember is that the dynamics of cooperation and the logic of capital changes at scale. This phenomena has inherent dangers that can produce perverse outcomes if not properly taken into account.

Thanks to Alex Deaton for providing several of the excellent sources in this post!